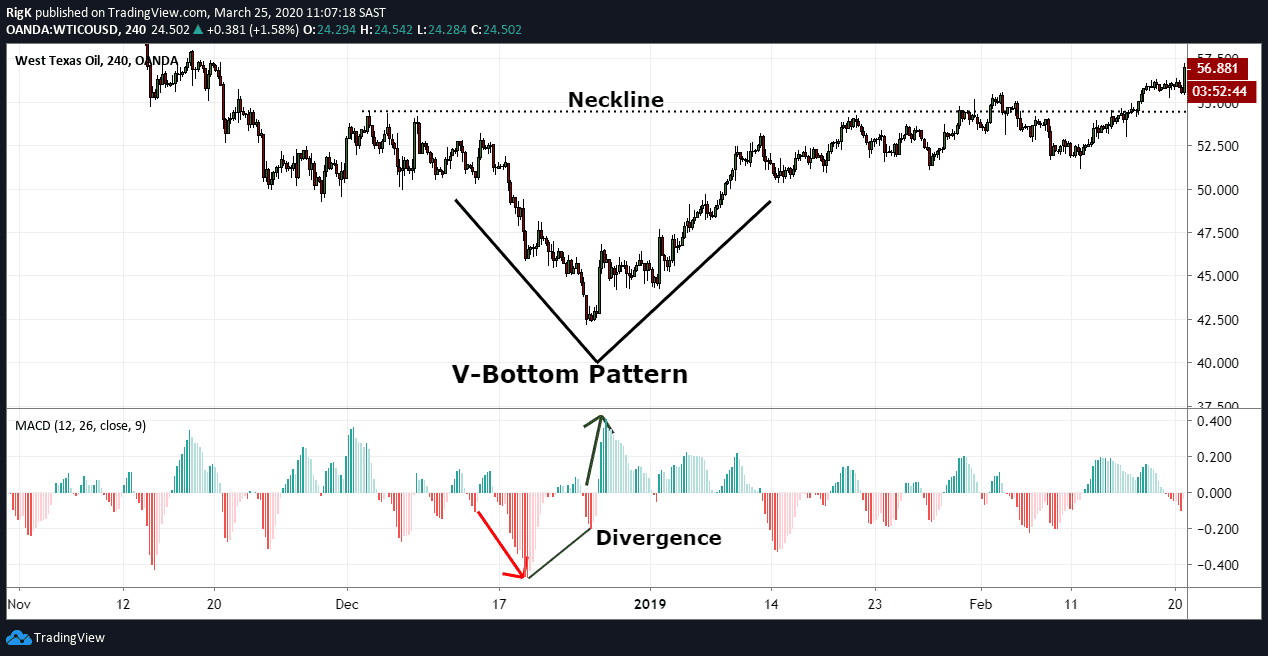

Advanced V-Bottom Pattern Recognition and Trading Strategies

V-bottom patterns represent exceptional trading opportunities when properly identified and executed. These formations typically develop over shorter timeframes compared to traditional reversal patterns like double bottoms or head and shoulders, making them particularly attractive for active traders seeking quick profit potential.

The most reliable V-bottom patterns exhibit several key characteristics: a sharp, sustained decline followed by an equally dramatic reversal, significant volume expansion during the reversal phase, and strong momentum continuation after the pattern completion. Professional traders often look for V-bottoms that occur at significant support levels, previous swing lows, or key Fibonacci retracement zones to increase the probability of successful trades.

Risk management becomes crucial when trading V-bottom patterns due to their inherent volatility. Successful traders typically place stop-loss orders just below the pattern's lowest point and use position sizing strategies that account for the increased volatility associated with these sharp reversals. Additionally, confirmation through momentum indicators and volume analysis helps distinguish genuine V-bottom formations from temporary price spikes that may quickly reverse.